TerraMetric

2020 looked to be the dawning of a modern day version of the roaring 1920s across the industry, with record-setting investment. Instead, a dramatic turn of events meant the parallels with that period also extended to respective pandemic similarities.

Despite the challenges, there were several drivers of success for TerraMetric: accelerating its strategy consulting services, belief in a multi-stakeholder approach to business, executing key partnerships, and embracing data, analytics, and innovation.

During the first months of the COVID-19 outbreak, TerraMetric, like many others in the NewSpace community, took a beat to understand the collective impact of an unprecedented global pause in business and a cultural awakening. As well as reeling from the effects of COVID-19, the world and the space industry became more aware of substantial social and racial injustice.

The mission of TerraMetric did not become one of "battening down the hatches" until the world returned to normal but instead one of engaging with the evolving global crisis with increasing intensity. TerraMetric's team delivered an incredibly strong performance for itself and its clientele thanks to this time-tested strategy.

Despite this year of adversity, TerraMetric will finish 2020 by outperforming 2019 by a factor of 3, with substantial global gains and well on the way to a third fiscal year with triple-digit growth. As 2020 progressed, and as it became increasingly clear that the COVID-19 pandemic wasn't going away, TerraMetric strengthened its focus to help its clients navigate unprecedented complexity and change.

In spite of extensive cancellations of worldwide industry events in the second half of the year and an inability to hold meetings in person with key clients and their stakeholders, TerraMetric hit the accelerator as it was already well-positioned to quickly and effectively pivot to 100 percent remote interactions. TerraMetric took the path of dealing with the challenges throughout the fiscal year "head-on," driven by a portfolio of diverse industry partners. It also immediately implemented effective measures, financially and operationally, to protect against the oncoming downturn.

These two strategic actions allowed TerraMetric to position itself for sustainable, profitable growth through 2020 and into 2021.

2020 Success Drivers

The essence of what makes TerraMetric exceptional has remained unchanged. TerraMetric's multi-faceted approach to growth strategy, based upon diversifying across the NewSpace value chain, has powered its success and continues to be a highly effective strategy for itself and its clients.

The diversification of TerraMetric's client and partner portfolio gives the company many dials to turn, driving the business forward, which has never been more critical. NewSpace, like most technology markets, moves extremely fast. TerraMetric views the industry through five and ten-year lenses to establish strategic focal points and make strategic annual adjustments.

The company studies industry trends using cutting-edge market insights to reflect the most promising growth areas across geographies, channels, vertical markets, and shifts in global economic, demographic, and social trends. The challenges of 2020 confirmed TerraMetric's strategies as many of the trends we have tracked within NewSpace have accelerated because of COVID-19.

Acceleration of Strategy Consulting Services

TerraMetric has long recognized the growth prospects of strategy consulting, which it has identified as a pressing need for NewSpace. Strategy consulting has been a critical area of focus and investment for the company, accelerating the business line in 2020 and providing a foundation for increased capabilities and scale.

As industry trends in NewSpace have become more evident, so has TerraMetric's investment in targeted personal services for this market, such as commercial strategy consulting, commercial due diligence, and executive training. Targeted investments have helped TerraMetric reach a broader range of New Space clients, who are increasingly shifting from technology demonstration and raising capital to focus on achieving commercial success.

TerraMetric spent much of 2020 initiating strategic initiatives that ensure the company is well-positioned to meet this growing need of the NewSpace market and unlock its potential.

Multiple Stakeholder Approach

The typical approach of NewSpace companies has traditionally been one of raising lots of finance and trying to conquer the market alone. From a revenue generation standpoint, as the realities of a slower global economy have become more apparent, a multi-stakeholder strategy for business growth became necessary in 2020.

Clients have increasingly embraced the TerraMetric approach to team building due to its quality, innovation, and creativity. TerraMetric delivered higher-than-expected sales growth in 2020 for every business line by building coalitions of clients and industry partners with complementary capabilities from throughout the market, working together to provide joint customers' solutions.

Key Partnerships

The importance of building relationships with organizations that can enhance client capabilities and reach new markets is more critical than ever. Despite the fact this has very much been a year for working in physical isolation, the TerraMetric team has established several exciting partnerships worldwide.

One prime example of these new, mutually beneficial relationships is the company's Teaming Agreement with Space BD in Japan, which enables TerraMetric to send payloads to the International Space Station (ISS).

Another exciting partnership is TerraMetric's collaboration with Euroconsult on the recently released EO4AG report, which has been tremendously well-received, with coverage in close to 30 agriculture and space publications worldwide. The report provides an in-depth analysis of the global trends, vertical integration opportunities and regional demand forecasted for Earth Observation-based services and products addressing the precision agriculture sector. This market is expected to reach over $815 million within the decade.

Data, Analytics and Innovation

With the high demand for data, analytics, and insights, the NewSpace market continues to accelerate in the downstream market.

TerraMetric's ability to identify growth opportunities across vertical markets, geographic markets, and market segments allow them to maximize value when delivering its clients' innovative products and services.

As the market quickly evolves, TerraMetric helps its clients harness more data than ever before and leverage analytics to generate actionable intelligence that delivers enterprise value, now and in the future.

To further strengthen these critical capabilities, Chad Baker and Andrew Pylypchuk have taken on the Vice President roles for the company as of August and September of 2020, respectively. In these positions, the two will be fundamental to building TerraMetric's priorities and accelerating growth.

TerraMetric introduced new services in all aspects of the organization's business this year, which have proven essential for clients. The company is firmly positioned to enter into the new year with optimism earned through hard work, maximizing opportunities, and fostering the collaborative approach at the core of the business.

Author Clint Graumann is the Chief Executive Officer and Co-Founder of TerraMetric and is considered to be one of the leading experts in the New Space economy. He has deep experience in the domestic and international markets. Clint and TerraMetrics’ team work in concert with clients to provide market intelligence, secure large contracts, and connect with partners and customers.

Terrasat Communications

This past year, the global pandemic has surprised everyone and with it, the new challenges that many in the satellite market industry had to face. But like many leaders in the industry, Terrasat Communications quickly adapted and moved forward to continue to provide superior Intelligent Block Upconverters (IBUCs) to satellite operations around the world.

While operating as an Essential Business during this pandemic, and maintaining California’s Public Health and Safety standards, Terrasat has pushed forward to deploy its products from orders that have been received from around the world. Terrasat’s ability to keep the factory open and productive has led to an increase in contracts to both upgrade existing equipment, and feature in newly launched SATCOM systems for both commercial and government sectors.

It all seems normalized now, but this was quite an accomplishment. Keeping a manufacturing line open in California at the onset of the pandemic meant establishing a completely new operating procedure that complied with strict safety standards such social distancing for floor personnel, constant temperature checks, cleaning, and occasional personnel quarantines. In addition to these challenges, there were daily obstacles with all the down the line parts manufacturers that Terrasat uses in their production.

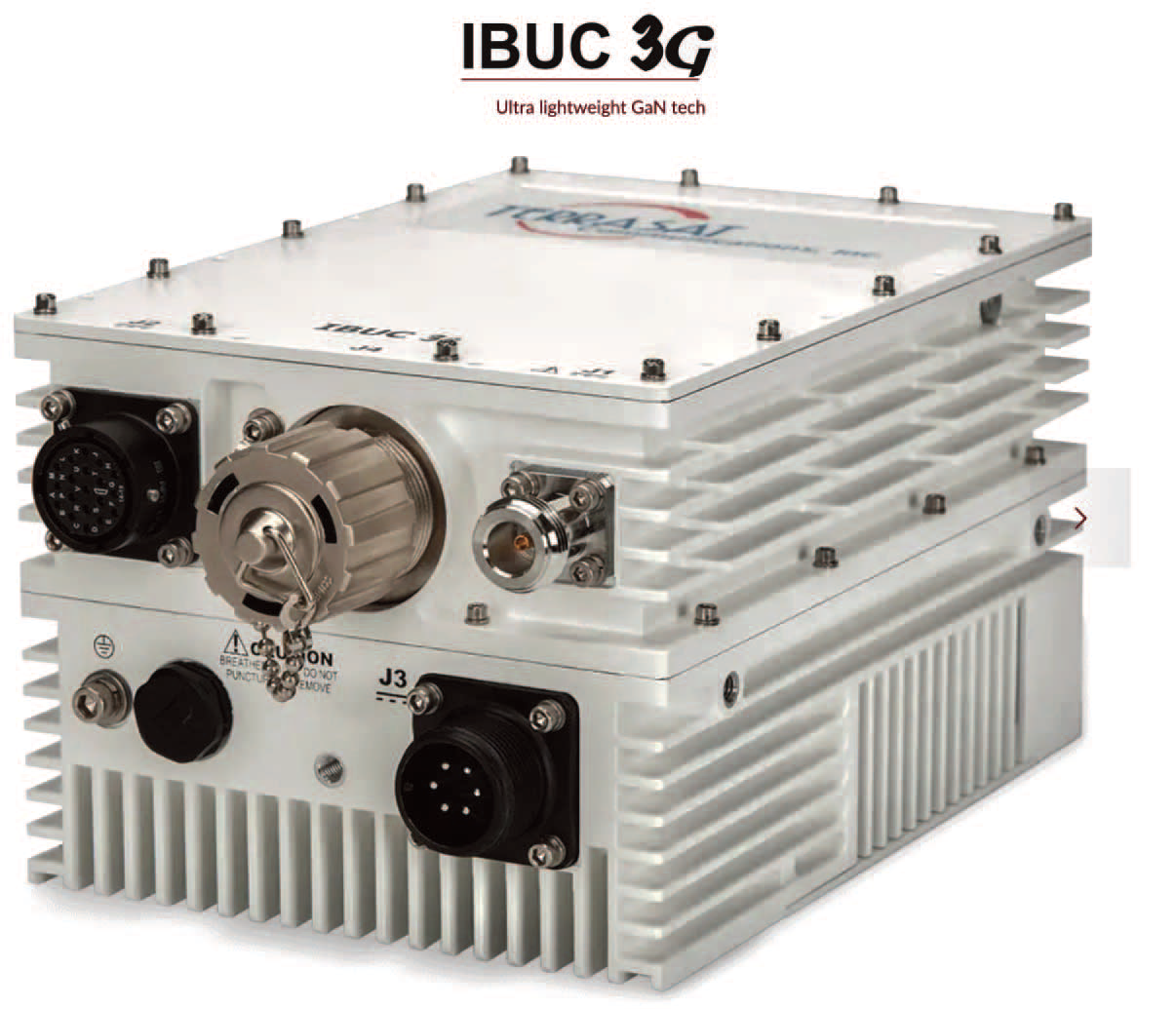

During the past year, Terrasat received multiple contracts with well-established vertical satellite antenna manufacturers. Terrasat, alongside with other strategic partners, upgraded the critical VSAT systems of a domestic government organization by integrating Terrasat’s new compact IBUC 3 units. Not long after, another contract was awarded with a global stabilized antenna manufacturer for prioritizing Terrasat’s mid-power Ku-band IBUC units for brand new satellite antenna systems.

In an uncertain world of living in a pandemic, Terrasat has consistently supplied IBUCs to meet the growing demand for reliable equipment with responsive remote site management and control capabilities for critical satellite communication.

Bob Hansen, Vice President of sales and Marketing commented on the year by saying, “The unique challenge for all of us was to adapt to a new normal. It was critical that we needed to keep everyone safe during the pandemic while continuing to build the products for our expanding customer base. Our customers and our partners were very understanding while we took the time to strike the right balance between safety, new procedures, and upgrading our equipment to churn out more quickly. It has been a fortunate year for us.”

Terrasat continued to scale to meet the growing customer needs, and all the while, balancing processes and testing to consistently deliver high quality reliable IBUCs. Terrasat Communications celebrated, with partners, the completed installation of high-performance satellite broadcast systems for the Africa Nations Championship in Cameroon. The order included deploying seven antenna systems featuring Terrasat’s 400W IBUC G redundant configuration just in time for the kick-off.

The 2020 successes in new contracts and orders has led Terrasat to expand its production facility. The increased production capacity will allow Terrasat to produce greater quantities of existing product and also produce new products such as the new generation IBUC, the IBUC 3.

Terrasat IBUC being manufactured in the

company’s factory.

The Ku-band IBUC 3 combines the intelligence and power efficiency of the IBUC 2 within a smaller size and weight profile. In addition to the IBUC 3, Terrasat is continuing to push forward with higher power GaN and GaAs BUCs to meet the needs of emerging hubs and uplinks for LEO and MEO satellites.

This past year, Terrasat also took the industry lead in responding to emerging market trends in cybersecurity. It is said that a communications link is only as secure as its weakest link. Many in our industry have realized that “intelligent BUCs” with IP connectivity can be easily exploited because of “low barriers” to foreign adverse actors.

Terrasat is offering exciting developments in SNMP V.3 cybersecurity enhanced IBUCs for industries across the world looking to strengthen their satellite ground station terminals from being exposed to vulnerabilities and attacks.

As we close out the tumultuous year of 2020, Terrasat remains poised for a successful 2021. Bob Hansen continued, “We have a lot of exciting products lined up for 2021. We’re committed to engineering the best BUCs on the market. Terrasat IBUCs are known for their reliability and performance. Our push into even higher power units and in particular, cybersecurity, will alter the course of the SATCOM industry. External and internal enhancements to an IBUC will benefit any industry concerned with outside threats.”

The new additions to Terrasat’s expansive product portfolio will allow Terrasat Communications to remain committed to being an industry leader by proactively responding to customer needs and engineering the gold standard of ultimate reliability and superior performance for commercial and government satellite communication. Terrasat looks forward to 2021 as the year these new products gain the high profile they deserve.

terrasatinc.com

Author Mike Gold is the Regional Vice President of the Americas and the Israel Region for Terrasat Communications.

Terrasat Communications designs and manufactures innovative RF solutions for Satellite Communications systems. Our ground-breaking IBUCs- brings advanced features and performance. All models include a web interface for extensive management and control and are SNMP-compliant for easy interface with any NMS. Terrasat’s IBUCs deliver superior reliability by holding up in extreme operating conditions made possible by extensive individual unit testing over temperature for optimal performance.

Thuraya Telecommunications Company: The Importance of Saatellite for Aerospace IoT

Today, there are about 35,000 planes in service worldwide, including all commercial and military aircraft. This number is expected to touch 60,000, registering nearly a 100 percent increase during the next 15 years.

Traditionally, satellite systems have played a key role in cockpit communications and coordination between aircraft and air-traffic control stations. But, with the advent of internet and all applications thereafter, Thuraya has started to see an increasing adoption of satellite-backed services for inflight communications on commercial aircraft and to enable bandwidth-hungry applications such as video surveillance on military aircraft.

Beyond passenger communications, aircraft operators are facing additional challenges related to safety and security of people and assets (e.g., Malaysia Airlines Flight 370, which disappeared in 2014 and is yet to be located) and reducing maintenance downtime and costs.

Unmanned aircraft, the numbers of which have increased exponentially, have accelerated the adoption of satellite connectivity and solutions. In fact, a research study has identified more than 150 different types of unmanned military aerial platforms with at least 20,000 drones in service.

All these numbers suggest that our skies are increasingly becoming crowded despite the ongoing COVID-19 crisis. Hence, satellite will be even more relevant, not only because of its ubiquitous nature transcending the limitations of terrestrial technologies, but also due to its reliability to augment any aircraft, regardless of its type.

Evolution of Aircraft Requirements

Aircraft are complex machines that have evolved over a long period of time to become increasingly automated to not only help pilots make better decisions but also enable operators to boost productivity and efficiency.

In this respect, real-time information has been increasingly critical not only as part of corrective actions, but as an important tool for predictive measures, which in many cases results in millions of dollars in savings per aircraft.

Satellite can enable different types of sensors ranging from location tracking, to engine performance, and kerosene consumption which are the key metrics that can be leveraged to enhance aircraft performance, maintenance downtime and cost. For this, terabytes of data are collected during each flight and in some cases need to be reported in real time to the ground, at least for the critical information and parameters.

Satellite-based IoT for aircraft is poised to be a standard, enabling problem-solving through data analytics. An example would be a real-time failure of an engine component, tracking cargo in the sky or replenishing unused inventories.

A major change is taking place with the rising usage of unmanned aircraft. Satellites will be even more indispensable for pilot-less aircraft. We have seen the initial premises with tests on F16 and more recently on Airbus 350.

Unique Satellite Advantages for Aerospace IoT

Since terrestrial cellular networks do not provide full coverage of the Earth’s landmass, the need for satellite-based connectivity for the IoT sector to reach its full potential is undisputed. Although 5G is right around the corner, the next generation of cellular mobile networks will definitely not fit every need especially during the cruising phase of a flight.

However, satellites hold a lot of promise and could be game changers. They can handle a majority of IoT operations – across vast, diverse geographies - drastically reducing the amount of investment needed in the sector. Satellites do not require costly ground-based infrastructure support and are technologically advanced to adapt to different platforms and standards, basically agnostic in terms of technology.

Key Benefits

Coverage — Expected to cover billions of devices around the world, the potential scale demands ubiquitous network coverage even in remote locations, which are best served by satellite networks.

Reliability — Maintaining a high level of service reliability is a key requirement for effective IoT deployments. The high reliability of satellite services holds a distinct advantage in supporting applications such as remote asset monitoring that requires reliable, always-on connectivity.

Cost — Satellite technology has the potential to be a versatile and cost-effective solution when it comes to ubiquitous connectivity. One network, one cost regardless of where you are is a highly compelling proposition. In general, satellite networks are agnostic to the technology deployed due to their operations in a bent-pipe model. Hence, they are really versatile and adaptive to support different technologies as desired by customers.

Integration — The rising demand for connectivity is expected to expedite the integration of satellite into the overall communications mix. Interoperability and convergence with terrestrial systems is an important value add for satellite systems, which enables seamless connectivity by increasing overall service availability.

L-Band uniqueness — For wide area IoT deployments where satellite is necessary, L-band is the best option because it supports smaller terminals facilitating easier installation/deployment. L-band networks are less prone to disruptions, providing reliable services even in unstable weather conditions. They have a wider beam width, and hence do not require high-quality and directive antennas that are expensive and mandatory for higher bands.

Yahsat’s and Thuraya’s Increasing Relevance

Yahsat and Thuraya have been very active during the last few years in the aerospace market. In fact, Thuraya already has a robust broadband aeronautical product offering within its portfolio that can be leveraged for IoT applications. Using its advanced network, the company and its partners have developed terminals to cater for the aero market segment. They have been certified for use on aircraft and helicopters such as the H145 by Airbus.

Thuraya recently showcased, during the Dubai Air Show, the capabilities of its L-band-powered Aero solution to key UAE government customers. By fulfilling the growing requirements for secure, always-on satellite-based aeronautical communications and applications, Yahsat is looking to further expand our strong partnership with the Government of the UAE. The successful demonstrations reflect the depth and magnitude of Yahsat’s aero mobility services to address multiple needs.

Additionally, a Thuraya technology partner has developed an L-band-based state-of-the-art communication solution for drones that is used not only for Command and Control but also for streaming videos and images. It has been tested and has subsequently generated great interest amongst government customers.

Apart from Thuraya, Yahsat has also executed a number of strategic partnerships such as its recent JV with Hughes Network Systems (HNS) that affords the company access to technology, experience and market reach beyond what it could do on its own. HNS is a key supplier to current inflight communications service providers in the market. They not only provide modem technologies, but also help operate services for key players in this space. Yahsat plans to leverage this experience for its own market entry. The company’s long-term partnerships with Boeing for the Phased Array antenna on specific government programs have given it valuable insights into the ongoing evolutions in antenna technologies.

In view of changing market dynamics, Yahsat and Thuraya are in the process of partnering with key IoT players in the market to launch a range of products and services addressing different market segments including aerospace deployment requirements. They aim to introduce cost-effective terminals, which will be easier to deploy, integrate and manage remotely.

Satellite Accelerates Aerospace IoT Growth

Satellite IoT will become even more relevant in the future. The market for IoT in aerospace and defense is estimated to be approximately $200 billion by 2023. Aerospace IoT is expected to deliver on 3 main objectives, namely...

1) Operational efficiencies

2) New revenue streams, and

3) Safety and security enhancements

While Wi-Fi deployments, Bluetooth and terrestrial GSM networks are able to support most applications, these network services simply cannot provide the ubiquitous coverage and seamless service required by aeronautical platforms — the ultimate success of the IoT in the aerospace segment depends on the active support of satellite networks — especially over oceans and seas that are outside cellular networks coverage.

IoT makes flights safer and more economical

Improved maintenance

Reducing grounding times, improving costs and efficiencies

Challenges Posed by COVID-19

The COVID-19 has had an unparalleled impact on aviation. Passenger traffic is almost negligible this year and thousands of aircraft are grounded. The ‘opening measures’ that are now being rolled out will lead to a certain “normalcy” in aviation and cruises in the next 12 to 18 months, at best. When conditions stabilize, connectivity will be a key differentiator in the value proposition offered by operators.

The interim period is enough for Thuraya Aero to evolve, hugely benefiting from Thuraya’s next generation mobility program. By 2024, when Thuraya 4-NGS enters commercial service, Thuraya Aero Next Generation (NG) will start delivering high throughput L-Band services, outperforming any mobile satellite service in the market. It is all set to become an established and reliable service for the global aviation community. Thuraya has a clear goal of achieving further line-fit certifications with aircraft manufacturers until commercial aviation reaches pre-pandemic levels and the demand for high-performance cockpit services rises significantly.

Meanwhile, on the ground, there is a rising need for cockpit connectivity from the government and the logistics sectors that is largely L-band driven. For search and rescue, border surveillance, ISR, telemedicine, logistics and military operations, aircraft need to fly on a daily basis. Thuraya has adequate resources to effectively fulfill those crucial needs.

thuraya.com

Sulaiman Al Ali is Deputy Chief Executive Officer (D/CEO) of Thuraya, the Mobile Satellite Services subsidiary of Yahsat. He was formerly the Executive Vice President (EVP) of the Commercial Division within Yahsat Government Solutions. As Deputy CEO, Sulaiman is focused on improving operations and revenue growth through enhanced communication services for Thuraya and Yahsat customers in the commercial and government/military sectors. He is also responsible for strengthening Thuraya’s commercial strategy, while leveraging the company’s breadth of services to provide customers in the government and military sectors with well-defined solutions that enable them to innovate.

W.B. Walton Enterprises, Inc.

Despite the huge challenges of the pandemic this year, at W.B. Walton Enterprises, Inc. (Walton De-Ice), we have been inspired by the humanity and resiliency of our customers, partners, colleagues and families. We are grateful for the privilege of continuing our fourth decade delivering the most innovative and effective solutions to help protect critical satellite networks from degradation and outages due to weather.

The Leader in Antenna Weather Protection Systems

Our core business at Walton De-Ice has been keeping Earth station antennas snow and ice-free with HOT AIR DE-ICE systems. We also address more than de-icing weather challenges alone. The Walton PORTABLE RADOME protects antennas and equipment from high winds, sandstorms, intense sun and heat. Walton RAIN DIVERTERS keep signal-busting water out of antenna apertures. RAIN QUAKE systems reduce water sheeting and antenna wetting attenuation, boosting Ka- Band performance.

C-Band 5G Transition with US

The FCC decisions around the C-band 5G transition this year have the company seeing requests for large projects and requirements for many de-icing systems to accompany retrofits of C-band ground infrastructure. C-band networks and affiliates should remember to include De-Icing in C-band antenna retrofit budgets in areas prone to snow, especially when FCC incentive funding is available.

Walton’s Hot Air De-Ice, ICE QUAKE and SNOWSHIELD systems help maximize uptime for critical satellite signals at major TV broadcast centers for leading TV programmers, as well as DBS, cable, telco, and mobile network operator head ends.

For large uplinks, the original WALTON PLENUM HOT AIR DE-ICE design mounts behind C-/Ku-/Ka-/X-/L-band antennas in sizes from 3.7 to 32 meters. Unlike competing anti-icing solutions, such as electric pad systems that can cause reflector distortion and outages, Walton Hot Air De-Ice systems heat the entire antenna reflector and back structure uniformly, ensuring Ku-/Ka band uptime.

Walton systems also uniquely offer maximum flexibility with electric, natural gas and liquid propane gas heater options. For even the most demanding Ka-band tolerances, our Infrared testing of antenna heating distribution validate our products’ optimal and superior performance.

Walton’s energy-saving SNOWSHIELD, and ICE QUAKE systems for 0.6 to 6.3 meter antennas have been field-proven to deliver the most cost-effective protection from ice and snow for hundreds of major cable and broadcast affiliates’ satellite antenna farms. The ICE QUAKE system, a super-low energy consumption solution for shedding snow off antennas from 0.6 to 6.3 meters, can deliver up to 100X energy-savings when compared to traditional anti-icing solutions, which is why it has been adopted in teleports, and cable and broadcast facilities worldwide.

Ensuring Customer Service

In 2020, despite pandemic challenges, we have continued to provide field installation and support services at many customer sites. We implemented safety measures to protect our employees and customers while maintaining production and customer support.

Customers can also leverage remote control features such as IP monitoring and control of their Walton systems if required when teleworking, for example, while pandemic worker safety restrictions are in effect. In 2021, we aim to get the word out more about our latest monitoring and control capabilities.

Portable Radome Traction in Defense Markets

As a U.S. Veteran-owned small business (CAGE Code 5Z770) manufacturer, we remain committed to serving U.S. Government requirements, whether via any of our prime contractor/systems integrators, distributors, or directly.

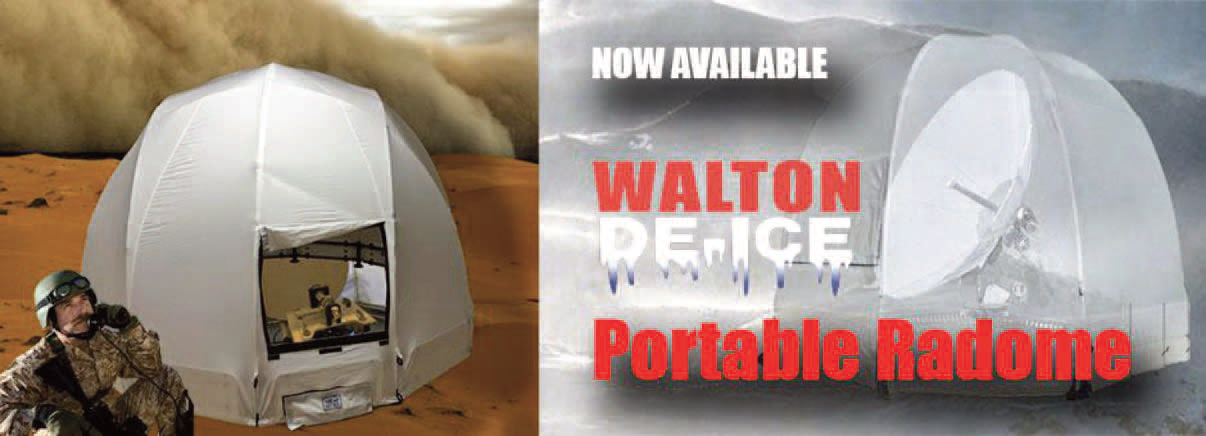

This year, Walton began shipping its re-designed PORTABLE RADOME — see the sidebar on the following page.

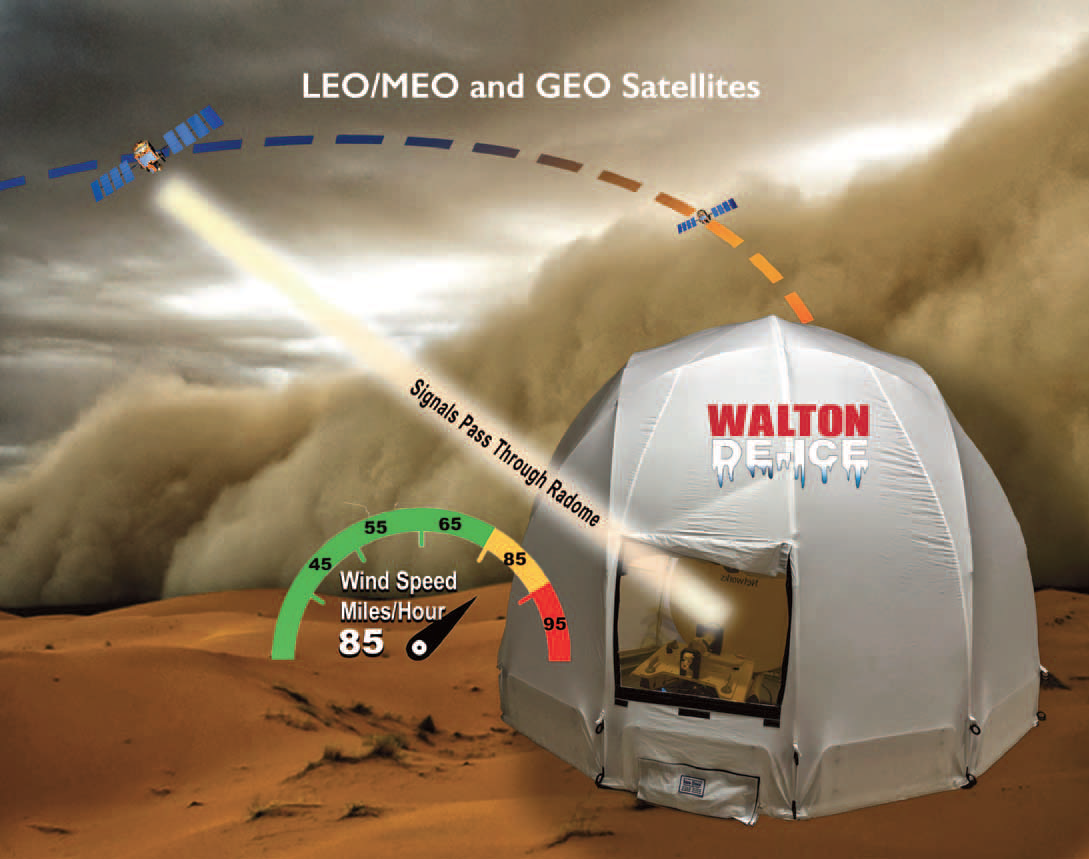

The new design offers expanded, full satellite-arc, line-of-sight protection for ground antennas, such as LEO gateways and MEO terminals for HTS, in addition to GEO. The PORTABLE RADOME provides a uniquely deployable weather protection solution for applications such as military vehicular mount terminals, Coms-on-the-Pause (COTP) terminals, VSATs, Transportable uplinks, Enterprise terminals as well as LEO/MEO gateways.

In 2020, multiple major Department of Defense (DoD) contractors ordered these units, in sizes up to 18’ x 12’, and we supported installations in military facilities in CONUS for several systems. These 2020 customer wins are in addition to PORTABLE RADOME shipments during 2019 for the U.S. Air Force, as well as deployments with two other major U.S. Federal contractors, and a European defense agency in separate customer projects.

The Portable Radome Solutions

Traditional antenna radomes are not built for transportable operation. Yet many of today's military and first-responder applications on land require deployable systems where harsh elements demand radome-like protection. The Walton PORTABLE RADOME unleashes a whole new set of possibilities for operating transportable satellite terminals (TST) and VSATs in extreme and mobile conditions to support civil or military requirements for high capacity data, voice and video capabilities worldwide.

The Walton PORTABLE RADOME can protect transportable, trailer and flyaway antennas from extreme conditions — snow, ice, intense heat, gale force winds (e.g.. 85 miles per hour), hailstorms, and sandstorms — for operation in climates ranging from alpine to desert. The PORTABLE RADOME can also be used for fixed site ground networks, and deliver gateway site cost-savings and other advantages. Lightweight and airline-shippable for rapid deployment, with easy setup in less than an hour by one person.

Walton’s PORTABLE RADOME goes where no radome has gone before to help urgent mobile terminals and VSATs stay online. Unlike our RF-friendly radome, some proposed substitutes actually have to open up a flap to allow RF signals to pass.

The PORTABLE RADOME uses architectural PTFE fabric material proven to deliver “no-leak” protection under heavy sand-blast conditions, unlike proposed substitutes such as cloth tents. Walton radome material withstands fine sand concentration (0.1- 20 g/m.) blown at up to 134 mile-per-hour intensity without damage. This ensures that antennas and electronics under the radome are protected, even in intense sand-blasting winds that can rip apart tents.

In burning desert sun heat conditions, an efficient forced air/HVAC system can be added to protect RF and electronics equipment underneath a Walton PORTABLE RADOME from damage due to overheating.

The PORTABLE RADOME, SNOWSHIELD, and ICE QUAKE all use unique PTFE architectural fabric that is permanently resistant to ultraviolet (UV) light and weather. As a result, Walton customers enjoy performance and total-cost-of-ownership advantages over antenna covers that use inferior materials, which degrade quickly unless removed and cleaned seasonally.

Looking Ahead

In spite of the very real challenges in our customers’ markets, we are hopeful that the promise of vaccines and a general economic recovery in 2021 will restore industry demand with renewed vigor.

Hunger for bandwidth will continue to drive the need for satellite capacity and services from traditional GEO and Ka-band HTS customers that demand our products today. We are excited about the prospects of LEO/MEO programs for the industry.

Constellations such as Starlink, Telesat LEO, and Amazon’s Project Kuiper are making technical and business progress, despite OneWeb’ setbacks this year. These systems will have ground antennas that require weather protection, which in turn creates demand from our customers for new solutions, an example being our radome products.

At Walton De-Ice, we look forward to partnering with our customers to develop and build even better ways to protect antennas and signals from the elements, whether for LEO, MEO, or GEO requirements.

de-ice.com

Author Ray Powers is Director of Sales & Marketing for W.B. Walton Enterprises, Inc. (“Walton De-Ice”) the world’s leading designer and manufacturer of satellite Earth Station Antenna (ESA) weather protection systems deployed globally. He has been with the company since 2010. Contact Ray at: [email protected].